In our country, there are two ways to insure an apartment. In the first case, you just need to start paying the fees indicated in the receipts of the housing and communal services, in the second case, contact the real estate insurance organization on your own. Both methods have certain pros and cons. In some cases, the wrong choice of insurance makes it not only useless, but also unprofitable.

In utility bills, voluntary apartment insurance began to be offered relatively recently. In some cities, already in this document you can see two options for payments for housing. One of them includes insurance coverage. It is enough just to start depositing the indicated amount so that the apartment is insured. It is not worth considering that this type of insurance is offered by the state, since they are engaged in providing payments to private companies that have signed an agreement with the management organization or have won competition.

Through this option, you can insure not only the apartment as a whole, but also structural elements, communications and much more. The standard list of insured events includes all kinds of accidents, explosions and fires. The only exception is the terrorist act. It should be borne in mind that the insured apartment begins to be considered a month after making the first installments. To use this type of insurance, you must be signed into the housing.

Of the advantages of voluntary insurance of this type, there is no need to spend your own time. In addition, the cost of insurance usually turns out to be slightly lower than with self-handling. But at the same time, one should not count on large amounts of compensation. Even with an almost completely destroyed apartment, more than six hundred thousand rubles will not work. Liability insurance this program does not provide.

Individual insurance is more expensive, but more flexible. Among the advantages, one can single out the opportunity to choose an insurer yourself. In addition, it will be possible to agree and indicate in the contract a list of risks that I would like to insure against. The frequency of insured events should be studied in advance in order to make an informed choice and choose exactly what can really threaten housing. Basically, people insure against flooding an apartment, and also conclude a civil liability insurance contract, which is closely related to it. Robberies, thefts, natural disasters, vandalism, fire account for significantly less contracts.

Insured events of the real estate itself are affected rather rarely, mainly the cost of equipment, furniture, decoration and everything else inside the apartment is reimbursed.

From the foregoing, we can conclude that the question of the profitability or disadvantage of a particular type of insurance to decide it is necessary individually, since with different initial data different insurance may be more effective programs.

-

10 rules on how to best repair an apartment for rent

10 rules on how to best repair an apartment for rent

-

Soundproofing and soundproofing of plastic windows

Soundproofing and soundproofing of plastic windows

-

The advantages of houses up to 150 square meters. m

The advantages of houses up to 150 square meters. m

-

What errors lead to water hammer in the heating system and how to avoid them

What errors lead to water hammer in the heating system and how to avoid them

-

12 tips for choosing a good construction team

12 tips for choosing a good construction team

-

How to make repairs once and for a long time

How to make repairs once and for a long time

-

5 reasons to change the wizard without waiting for the repair to finish

5 reasons to change the wizard without waiting for the repair to finish

-

When is it better not to glue paper wallpapers?

When is it better not to glue paper wallpapers?

-

Why you can’t save money by installing infrared heating instead of gas

Why you can’t save money by installing infrared heating instead of gas

-

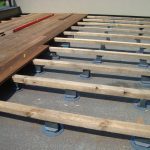

When an adjustable floor is more profitable than a capital screed

When an adjustable floor is more profitable than a capital screed

-

Smart sockets: why call a coffee maker or kettle

Smart sockets: why call a coffee maker or kettle

-

7 mistakes that people usually make when self-organizing home construction

7 mistakes that people usually make when self-organizing home construction

New publications are published daily on our channel in Yandex. Zen

Go to Yandex. Zen